Vehicle insurance is mandatory for all vehicles in India as per the Motor Vehicles Act, 1988. Driving without valid insurance can result in heavy fines and even imprisonment. You can now easily check your vehicle insurance status online through the Parivahan portal.

This guide explains how to verify your vehicle insurance validity, check policy details, and understand the importance of keeping your insurance updated.

Why is Vehicle Insurance Important?

- Legal Requirement: Mandatory under Motor Vehicles Act

- Financial Protection: Covers damages to your vehicle and third parties

- Medical Expenses: Covers hospitalization costs in case of accidents

- Third Party Liability: Protects against claims from others

- Peace of Mind: Secure driving without financial worries

How to Check Vehicle Insurance Status Online

Method 1: Using Parivahan Portal

- Visit parivahan.gov.in

- Go to "Informational Services"

- Click on "Know Your Vehicle Details"

- Enter your mobile number for OTP verification

- Enter your Vehicle Registration Number

- Fill the Captcha and click "Search"

- View insurance details in the vehicle information

Method 2: Using IIB (Insurance Information Bureau) Portal

- Visit iib.gov.in

- Click on "Vehicle Insurance Status"

- Enter Vehicle Registration Number

- Enter Chassis Number (last 5 digits)

- Fill Captcha and submit

- View insurance policy details

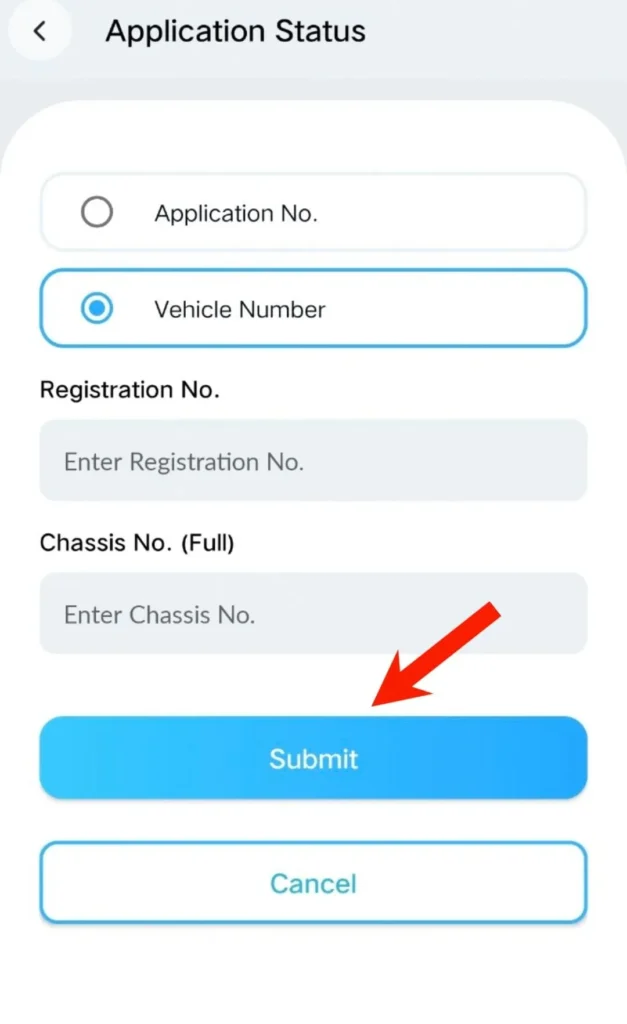

Method 3: Using mParivahan App

- Download mParivahan from Play Store/App Store

- Register with your mobile number

- Go to "RC" section

- Enter vehicle registration number

- View insurance status along with other details

Insurance Details Available Online

| Information | Availability |

|---|---|

| Insurance Status | Active/Expired |

| Insurance Company Name | Available |

| Policy Number | Partially Masked |

| Policy Start Date | Available |

| Policy Expiry Date | Available |

| Insurance Type | Third Party/Comprehensive |

Types of Vehicle Insurance

| Insurance Type | Coverage | Mandatory |

|---|---|---|

| Third Party Only | Damages to third party (person/property) | Yes |

| Comprehensive | Own damage + Third party + Theft + Fire | No (Recommended) |

| Own Damage Only | Only own vehicle damage | No |

| Zero Depreciation | Full claim without depreciation deduction | No (Add-on) |

Penalty for Driving Without Insurance

| Offense | Penalty |

|---|---|

| First Offense | ₹2,000 fine and/or 3 months imprisonment |

| Second Offense | ₹4,000 fine and/or 3 months imprisonment |

| Accident without Insurance | Personal liability for all damages + Legal action |

How to Renew Vehicle Insurance Online

- Check your current policy expiry date

- Compare insurance quotes from different companies

- Visit the insurance company's website or aggregator portal

- Enter vehicle details and personal information

- Choose coverage type (Third Party/Comprehensive)

- Select add-ons if required (Zero Depreciation, Roadside Assistance, etc.)

- Pay premium online

- Download the policy document instantly

Popular Insurance Companies in India

| Public Sector | Private Sector |

|---|---|

| New India Assurance | ICICI Lombard |

| United India Insurance | HDFC ERGO |

| National Insurance | Bajaj Allianz |

| Oriental Insurance | Tata AIG |

| - | SBI General |

| - | Reliance General |

Insurance Add-ons to Consider

- Zero Depreciation: Get full claim without depreciation deduction

- Roadside Assistance: 24x7 help in case of breakdown

- Engine Protection: Covers engine damage due to water logging

- NCB Protection: Retain No Claim Bonus even after a claim

- Personal Accident Cover: Additional cover for driver/passengers

- Return to Invoice: Get full invoice value if vehicle is stolen/totaled

What is No Claim Bonus (NCB)?

NCB is a discount offered by insurance companies for not making any claims during the policy period:

| Claim-Free Years | NCB Discount |

|---|---|

| 1 Year | 20% |

| 2 Years | 25% |

| 3 Years | 35% |

| 4 Years | 45% |

| 5+ Years | 50% (Maximum) |

Frequently Asked Questions

1. Can I drive with expired insurance?

No, driving with expired insurance is illegal and can result in fine up to ₹4,000 and/or imprisonment.

2. How can I transfer insurance to a new owner?

The buyer needs to apply for transfer within 14 days of vehicle purchase. Visit the insurance company with vehicle transfer documents.

3. What happens if I miss insurance renewal date?

Most companies offer a grace period of 90 days. After that, you may need to get the vehicle inspected before renewal.

4. Is DigiLocker accepted for showing insurance?

Yes, insurance documents stored in DigiLocker are legally accepted by traffic authorities.

5. Can I get insurance for a vehicle without RC?

No, a valid RC is required to purchase vehicle insurance. For new vehicles, the dealer handles temporary insurance.